Our Speakers

LUCY PETRY

Lawyer

Lucy Petry has established a reputation as a leading source of tax advice within the tax industry for her reliability, dependability, and innovation.

Highlights of Mrs. Petry’s career include: working over 20 years in both business and public accounting; carrying on the IRS Volunteer Income Tax Assistance (VITA) program for more than 20 years; and establishing her own tax law firm where she has been able to relieve taxpayers of millions in tax liability.

Mrs. Petry teaches two graduate courses: Taxation of Business Entities and Individual Taxation at the University of St. Thomas in Houston, and previously taught the income tax clinic at South Texas College of Law Houston. She is an active member of the Tax Section for the State Bar of Texas and a frequent speaker at conferences and legal events in the topics of tax law and tax resolution.

Lucy Petry started Petry Law Firm, PLLC, not for profit or notoriety, but because she has a real desire to help individuals and businesses with their legal needs. Lucy has years of experience in the business world, as well as with the IRS thanks to her time working with the IRS Volunteer Income Tax Assistance program (VITA). Lucy is the VITA program site manager for both the University of Saint Thomas and South Texas College of Law and has personally supervised and prepared over 15,000 tax returns, which makes her well-equipped to handle your business and IRS issues. She has now worked for VITA for more than 20 years.

In addition to the VITA program, Lucy has experience in both industry and public accounting, managing and consulting for businesses, assisting taxpayers from tax preparation to representation before the Tax Court, and representing clients at the federal, state, and local levels. Prior to becoming an attorney Lucy managed her CPA practice and worked as a Controller and Accounting Manager for public and International manufacturing companies.

Lucy earned her MBA from the University of St. Thomas in Houston, followed by her JD from the South Texas College of Law Houston. While at South Texas, she earned the University and Texas State Bar Pro Bono Honors award. She was also the President of the Tax Law Society and a member of the Board of Advocates. She then went on to become an Adjunct Tax Clinic Professor at South Texas.

ROBERT NORDLANDER

CPA, CFE, EA, & Former IRS Criminal Investigator

Unlike many who claim the title, Robert Nordlander has not only studied but also lived the life of a forensic accountant. His journey in financial investigation began more than two decades ago with the IRS-Criminal Investigation, revered globally as the epitome of financial investigative excellence.

His expertise is recognized nationwide. He’s led investigations featured on TV shows like The Dr. Phil Show and in publications, such as the New York Times. Robert also shares his knowledge by speaking on stage at national conferences and through bestselling books focused on criminal tax and payroll tax problems. He excels at interviewing witnesses, preparing them for trial, and writing detailed reports that present complex information in an understandable format. Robert has interviewed over 1,000 witnesses, building rapport, uncovering the truth, and preparing them for grand jury and trial testimony. His reports, supported by strong evidence, clearly prove the elements of a crime or the facts of an investigation.

As a special agent, Robert investigated a wide range of financial crimes, including income, employment, and excise tax violations, embezzlements, wire fraud, mail fraud, gambling, drug trafficking, bank fraud, money laundering, structuring, and bankruptcy fraud. He’s seized millions of dollars in ill-gotten gains and helped courts understand the financial story of countless cases. His work has been featured on TV and in top newspapers.

His comprehensive understanding of tax laws and IRS procedures ensures he offers qualified representation in audits and tax disputes. Robert knows what questions to ask and can effectively represent clients in audits or collection activities. He also authored two books on IRS representation: “Unpaid Payroll Taxes: A Time Bomb You Can Defuse” and “Erase the Penalty: A Tax Professional’s Guide to Abatement.”

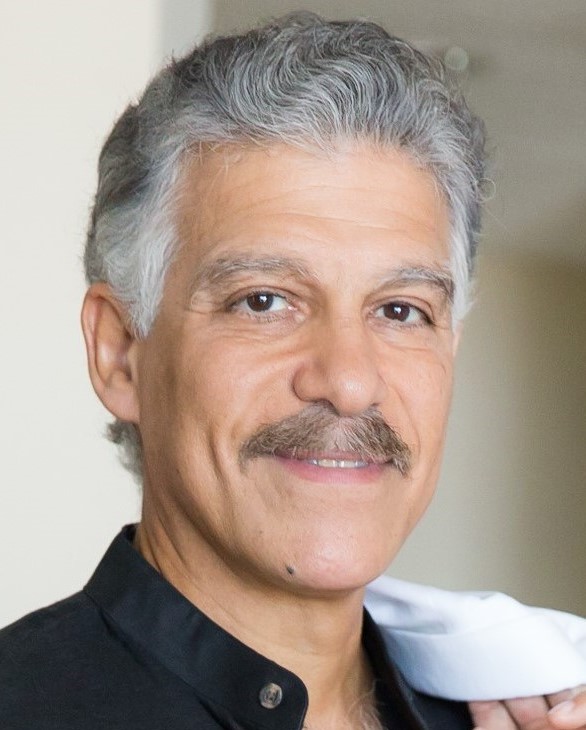

LUIS O. RIVERA

CPA, CFE, CFF, Former IRS Criminal Investigator

Luis O. Rivera is currently a Partner at the MRW Consulting Group® specializing in white collar crime litigation support, international and domestic investigative services, civil and criminal tax controversy, anti-money laundering and bank secrecy act services, financial fraud investigations and law enforcement training and reviews. At the MRW Consulting Group®, Luis has serviced numerous clients in the areas of voluntary disclosures, civil fraud matters, tax controversy issues, and forensic support on criminal and civil tax and fraud cases to include mortgage fraud, contract disputes cases, and business consulting.

Prior to the MRW Consulting Group®, Luis worked in a Public Accounting firm in South Florida in the Advisory Services Division. At the firm, Luis worked on tax related matters including matrimonial cases, tax audits, litigation support and collection and criminal tax matters. Luis also worked on contract dispute cases providing forensic expertise. In addition, Luis expanded the Firm's practice to include work on Money laundering/forensic accounting matters internationally. Luis has developed criminal cases for trial and testified in various forums including US District court and administrative hearings. Luis brings 28 years of experience with the IRS Criminal Investigation Division and the Inspector general's Office of the Agency for International Development (USAID) Luis served as Special Agent, Foreign Service officer, Supervisory Special Agent, and task force Deputy Director finally retiring as the Assistant Special Agent in Charge (ASAC) of the Miami Field Office. As ASAC in IRS Criminal Investigations, Luis provided leadership directing field operations of the field office (Miami) with over 160 employees. He provided guidance and stewardship over program implementation, and plan execution. He had investigative, administrative and approval authority over complex, multi-jurisdictional tax, money laundering (Bank Secrecy Act) and financial fraud cases covering South Florida, Puerto Rico and the US Virgin Islands. Additionally, he was responsible for implementing the IRS criminal Investigations business plan, conducting operational reviews, approving and overseeing tax fraud, white collar crime, and money laundering investigations, including undercover operations.

MARCI BARKER

Author, Accountability and

Business Coach

As a life and business coach, accountability is my specialty.

My journey began when I invested deeply in myself—10 months, tens of thousands of dollars, and countless hours of growth.

These investments helped me scale my business and uncover my passion for true accountability.

I’ve been mentored under Marshall Goldsmith and written a book on accountability, helping thousands of clients follow through on their goals.

I thrive on seeing the confidence my clients gain when they trust themselves and apply

The Accountability Code to every aspect of life and business. My process makes follow-through easy and peaceful, leading to extraordinary results.

At the core of my work is the belief that true happiness comes from aligning our actions with spiritual principles, empowering you to live a life in tune with your deepest values.

I’m an extrovert, a lover of Legos, body combat, and organizing creative fun with my four daughters, ages 9-15. I met my husband in a Walmart parking lot, and we’re still going strong after 17 years.

My family is my world and the reason I built my business around them, not the other way around. My approach to coaching is influenced by this deep connection to family, growth, and accountability.

My framework is designed to help you strategically work through each step of your goals, making it easier to define, execute, and achieve with confidence.

My clients often say I make them feel like they’re the only one I’m working with because of my personal and genuine approach. I’m known as the “Loving Kick in the Pants” because I empower clients to take action in a supportive and non-judgmental way.